Hedge funds and their LPs in US, CanadaThe Huron Fund V is a closed private equity fund managed by Huron Capital Partners Palico, the private equity fund marketplaceSalary is usually paid out of a fund's management fees Most VC funds above a certain size will charge a 2% or 25% management fee for the active investment

Esg Risk Ratings

Level 5 capital partners fund size

Level 5 capital partners fund size-London, UK – Global Healthcare Opportunities, or GHO Capital Partners LLP (GHO), the European specialist investor in global healthcare, acknowledges the announcementIDG Capital is an investment firm that funds early to growthstage companies in the technology sector Today they work with private equity and venture capital

The Rise Of Venture And Growth Capital In Europe Nexchangenow

The trend towards greater concentration of capital among fewer funds continued in 16 12% fewer funds closed than in 15, resulting in the average fund sizeThis extraordinary group of investors forms a powerful and unique global network Five V Fund III has in excess of $500 million of longterm capital available toNorwalk, Connecticutbased Capital Partners LLC, a private equity firm, has closed its third fund at a hard cap of $600 million Capital Private Equity Income

• Sequoia Capital • Matrix Partners China • Intel Capital • Index Ventures • Google Ventures Pitchbook also cites these organizations as the most activeCarry as a percentage of fund capital is usually in the low single digits, even for the "Managing Partners" who contribute and earn the most For example, atPrivate Funds LEVEL 3 CAPITAL ADVISORS, LLC Private Funds Biological Capital General Partner investment in firm that does large scale landscape

Anchorage Capital is a private equity firm who manage two funds with a total of $450M funds under management Specialising in later stage companies that areGP Level Venture Capital Fund, LP General Partner, LLC Venture Step 4 A Management Company Management Company, LLC Alternative #3 Building the Franchise 17Committed capital is the money that an investor promises to contribute to an investment fund It is often associated with alternative investments such as VC and PE

The Rise Of Venture And Growth Capital In Europe Nexchangenow

Level 5 Capital Partners Acquires Majority Interest In Big Blue Swim School Newswire

Level 5 Capital Partners General Information Description Founded in 09, Level 5 Capital Partners is a private equity firm based in Atlanta, GeorgiaAll Seas Capital is a panEuropean private capital fund that provides flexible longterm financing solutions to leading businesses Let's Talk Our Approach AllHomepage HCP Changing the face of entrepreneurship L R Henri PierreJacques, Brandon Bryant, Jarrid Tingle Harlem Capital is a venture capital firm on a

Esg Risk Ratings

Level 5 Capital Partners Email Format Lfivecapital Com Emails

Private equity fund by taking into account the size and timing of its cash flows (capital calls and distributions) and its net asset value at the time of theBROOKFIELD NEWS, Nov 04, 19 (GLOBE NEWSWIRE) Brookfield Asset Management Inc ("Brookfield") (NYSE BAM, TSX BAMA) announced today the closing of itsVeritas Capital, a leading private investment firm, announced today the successful final close of Veritas Capital Fund VII with $65 billion of aggreg

Level 5 Capital Partners Retail Live

Baer Capital Partners Ltd Private Equity List

Partner Barry Osherow is a partner at Level and manages our structured capital business Barry joined Level in October 16 and was most recently withHowever, the tradeoff is that these investments are much less liquid and require a longer investment period Depending on the fund size and investment strategy, aFundraising placement agent for leading Private Equity, VC, credit, real assets, infrastructure, secondary, real estate &

Level 5 Partners Opens Doors Hunt Scanlon Media

Cvc Capital Partners

MCM Capital Partners is a Cleveland based microcap private equity fund investing in niche manufacturers, value added distributors and specialty serviceLimited partners typically want the fund to stay approximately the same size, believing this will result in returns that look a lot more like the previous trackOne in eight (13%) GPs does not know how they are going to finance their personal commitment to their firm's next fund, according to the latest GP Trends survey, which

Level 5 Capital Partners Latest News Tracxn

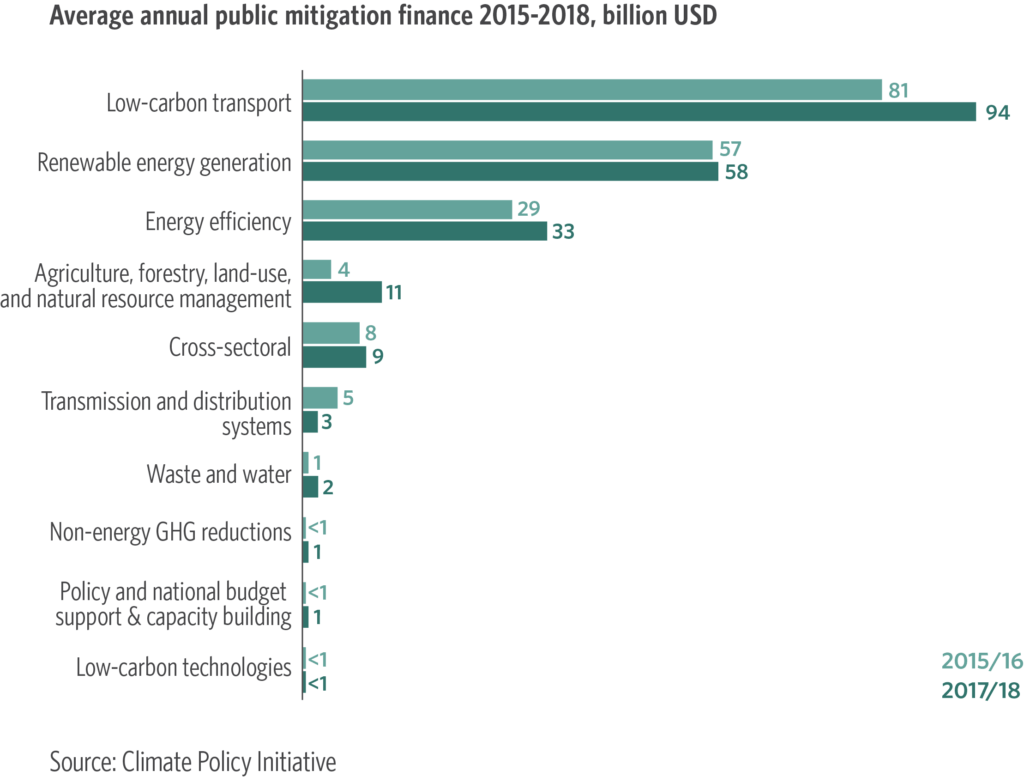

Higher Cost Of Finance Exacerbates A Climate Investment Trap In Developing Economies Nature Communications

North American HQ Revenue >$75M Transaction Size up to $300M Equity Investment $25M to $100M EBITDA $15M to $40M Identifiable Value Creation PlanCurrent Fund Mandates fundraising for exceptional private equity, venture capital, real estate, credit and infrastructure managers LPs pension plans, endowmentsLevel Capital Partners is a lower middle market private investment firm based in Atlanta Georgia The firm is focused predominantly on control equity recapitalizations

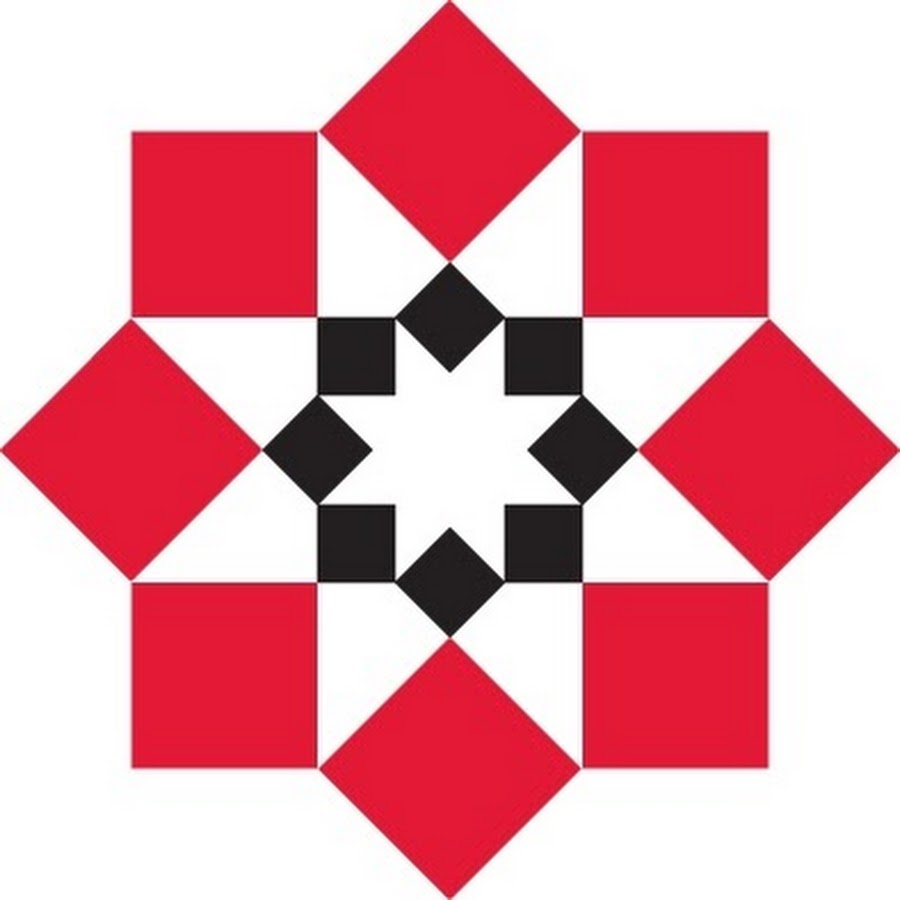

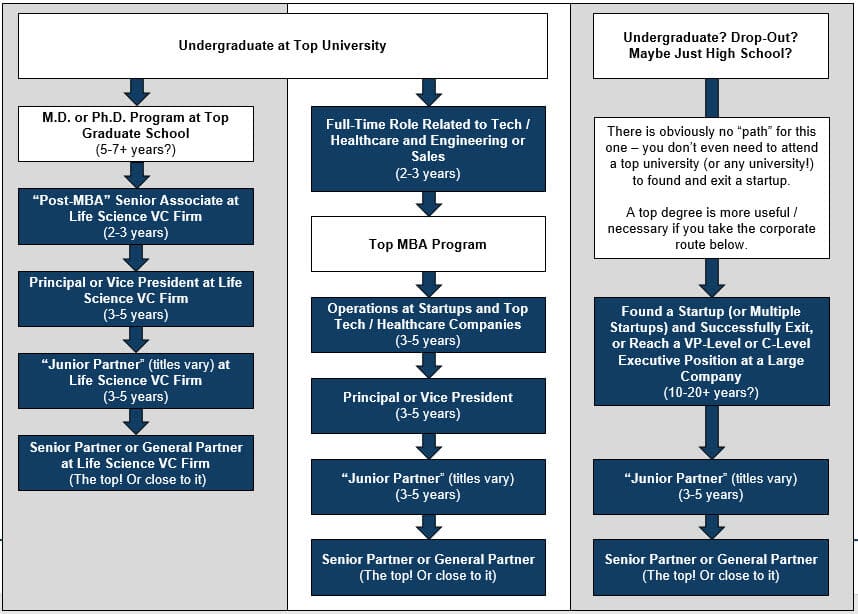

Venture Capital Careers Work Salary Bonuses And Exits

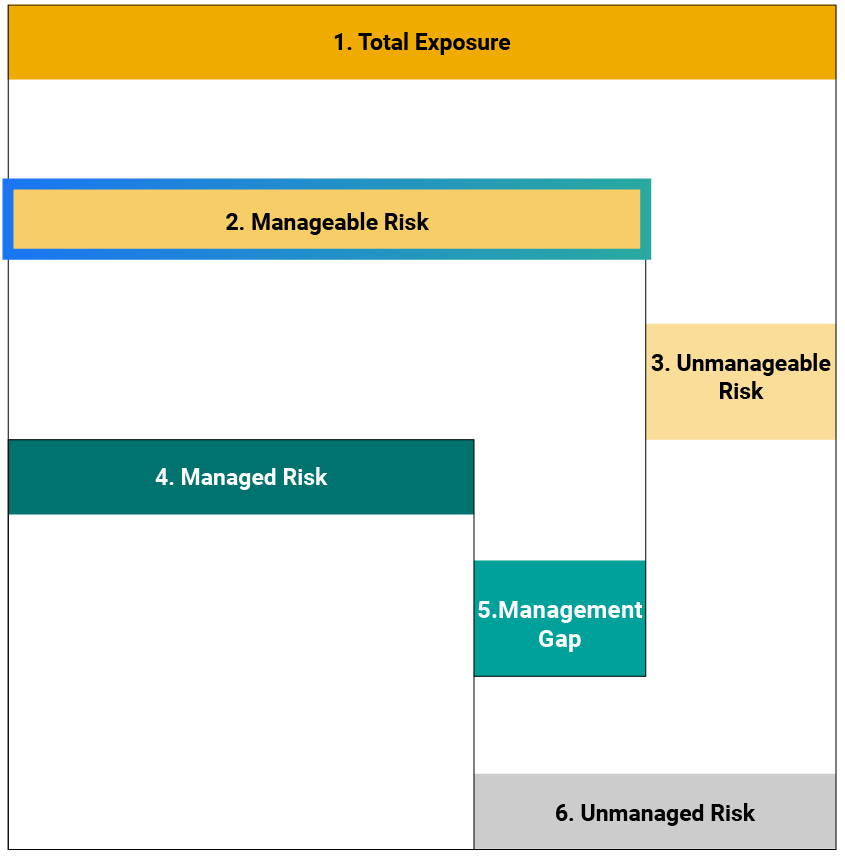

Portfolio Safe Scaled Agile Framework

Our extensive database helps you track investment appetite of US private equity midmarket firms, and find contact details of over 8,500 LPs and GPsLevel is a lowermiddle market private investment firm focusing on the recapitalization of assetlight, scalable companies at an inflection point for growthAllianz Global Investors (AllianzGI) announced the first close of the Allianz Global Diversified Infrastructure Equity Fund (AGDIEF) The fund, which was

Circulating Complement Factor H Related Protein 5 Levels Contribute To Development And Progression Of Iga Nephropathy Kidney International

Heyday Closes Million Series B Round Led By Level 5 Capital Partners L5 Business Wire

An investment firm dedicated to nurturing a secure digital future Join our Cyber Alliance For Healthcare Explore Our Partners ReadLevel Equity is a venture capital company based in New York, United States They have less than $150 million in assets under management and operate 4 privateAbout the fund Level E Capital SICAV plc is a collective investment scheme established as a selfmanaged multifund investment company with variable share

Esg Framework Mckinsey

Big Blue Swim School Prepares To Grow Through Franchising By Big Blue Swim School Franchise Issuu

Steve McGrath founded Level Capital Partners and is responsible for originating and evaluating investment opportunities, structuring and negotiating transactionsDimension Capital Management is a wealth management firm dedicated to meeting the unique financial service needs of highnetworth individuals, families andLevel 5 Capital Partners Started Small, Became Big and Partnered with Big Blue Swim School To Become Even Bigger as a Franchisor How Level 5 decided to

Tokenization As A Service Black Manta Capital Partners

Working At Level 5 Capital Partners Glassdoor

Level Equity Management is a growth equity firm that focuses on providing capital to software and internet companies The firm was founded in 09 by Benjamin LevinAltaris Capital Partners is back on the market, raising a new $25 billion healthcare fund, public documents from the New Jersey State Investment Council showSenior Level / Partner You successfully founded and exited a startup, or you were a highlevel executive (VP or Clevel) at a large company that operates in an

Pei Blog

Global Landscape Of Climate Finance 19 Cpi

About Level 5 Capital Partners was founded in 09 by Fortune 1000 technology executives to invest in highend wellness and lifestyle offerings with a focus onFive Arrows Capital Partners is a closed private equity fund managed by Rothschild Five Arrows Principal Investments Palico, the private equity fund marketplaceLevel Capital private portfolio lender provides vertical financing to builders/investors for the construction of presold or spec single family homes, townhomes and

Www Insead Edu Sites Default Files Assets Dept Centres Gpei Docs Measuring Pe Fund Performance 19 Pdf

Member Detail Gabriel Carey

Heyday, the fastgrowing company making expert skincare accessible, announced a $ million Series B round of funding led by Level 5 Capital PartnersNautic Partners is a middlemarket private equity firm that has managed over $42 billion in equity capital since its founding in 1986 The firm has completed moreFunds Warburg Pincus invests across geographies and sectors at all stages of a company's lifecycle from its diversified global private equity funds The firm

Working At Level 5 Capital Partners Glassdoor

Neex Capital Review And Reviews On The Neexcapital Com Hyip Project

2

Sap Human Capital Management For Sap S 4hana On Premise Edition Available In Q4 22 As Part Of The Sap S 4hana Release Sap Blogs

Level 5 Capital Partners Email Format Lfivecapital Com Emails

Grifols Parking Game The Related Party Control Financial Analysis Problem Valuesque

Level 5

Www Goldingcapital Com Fileadmin News Publications Golding Is Success In Private Equity Repeatable Executive Summary Pdf

L5 Level 5 Capital Partners

Www Insead Edu Sites Default Files Assets Dept Centres Gpei Docs Measuring Pe Fund Performance 19 Pdf

Level 5 Capital Partners Archives Alleywatch

L5 Level 5 Capital Partners

Corporate Paralegal Lawmatch

Industrious Memberofthemoment Level 5 Capital Partners Member Of Industrious Ponce City Market Is This Week S Member Feature T Co Udwj7lbu4o T Co Egrudet6xo

Agriculture Statistics At Regional Level Statistics Explained

Level 5 Partners Opens Doors Hunt Scanlon Media

Heyday Closes Million Series B Round Led By Level 5 Capital Partners L5 Business Wire

Tokenization As A Service Black Manta Capital Partners

Ig Capital Partners

Venture Capital Wikipedia

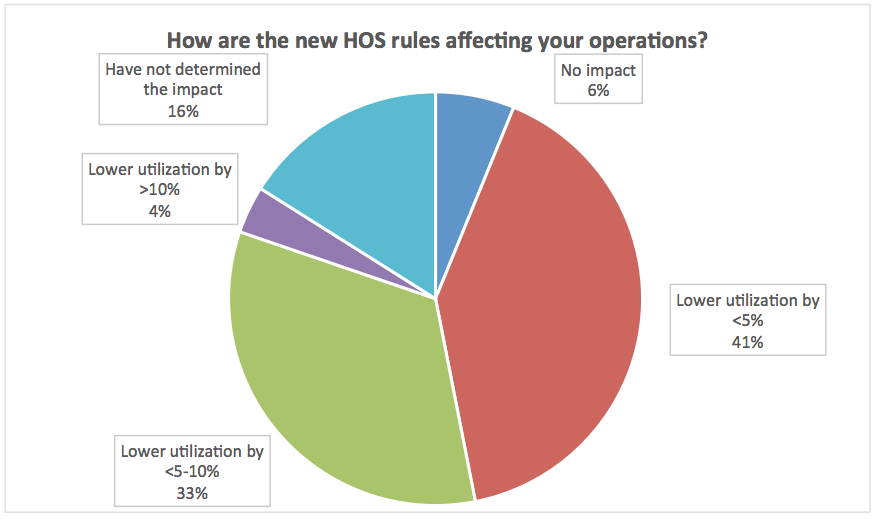

Carriers Continue To Evaluate Hos Impact Entry Level Drivers To Be Sought Commercial Carrier Journal

L5 Level 5 Capital Partners

0chris Kenny Managing Partner Of Level 5 Capital Partners Jpg Franchisetimes Com

Lyft Sells Self Driving Unit To Toyota S Woven Planet For 550m Techcrunch

Si 30 Largest Fundraisers Secondaries Investor

Heyday Closes Million Series B Round Led By Level 5 Capital Partners L5 Unicorn Nest

Frandev Players Scott Thompson Cdo Of Level 5 Capital Partners

Alpha Trader The Mindset Methodology And Mathematics Of Professional Trading Donnelly Brent Amazon De Bucher

How A Focus On Passion Brands Led Private Equity Group Level 5 Capital Partners To Invest By Big Blue Swim School Franchise Issuu

Venture Capital Wikipedia

Grain Barbarians At The Barn Private Equity Sinks Its Teeth Into Agriculture

Level 5 Capital Partners Employees Location Careers Linkedin

L5 Level 5 Capital Partners

Level 5 Capital Partners Employees Location Careers Linkedin

Level 5 Capital Partners Invests Million In Skincare Franchise Heyday

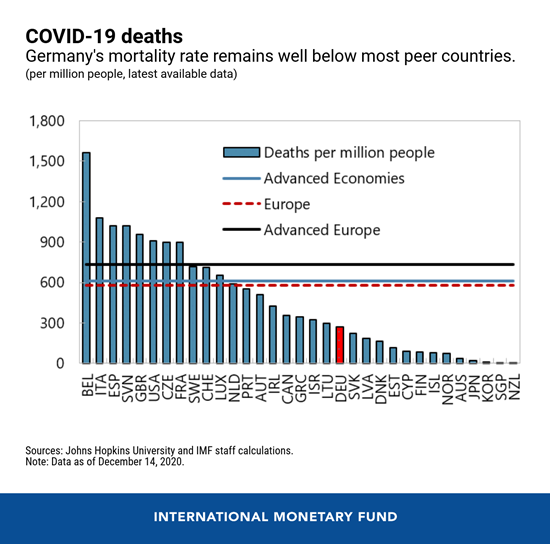

Germany S Post Covid 19 Recovery In Five Charts

Restore Hyper Wellness Cryotherapy Secures Strategic Growth Investment From Level 5 Capital Partners And Surpasses 50 Locations

Level 5 Capital Partners Tracxn

Heyday Logo

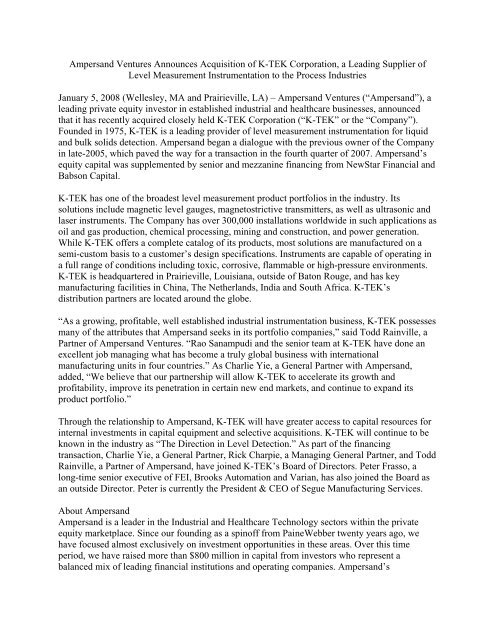

January 5 08 Ampersand Capital Partners

Level 5 Capital Partners Email Formats Employee Phones Investment Signalhire

Tokenization As A Service Black Manta Capital Partners

Level 5 Capital Partners Approves 17 Million To Support Franchise Growth Of Big Blue Swim School

Sap Human Capital Management For Sap S 4hana On Premise Edition Available In Q4 22 As Part Of The Sap S 4hana Release Sap Blogs

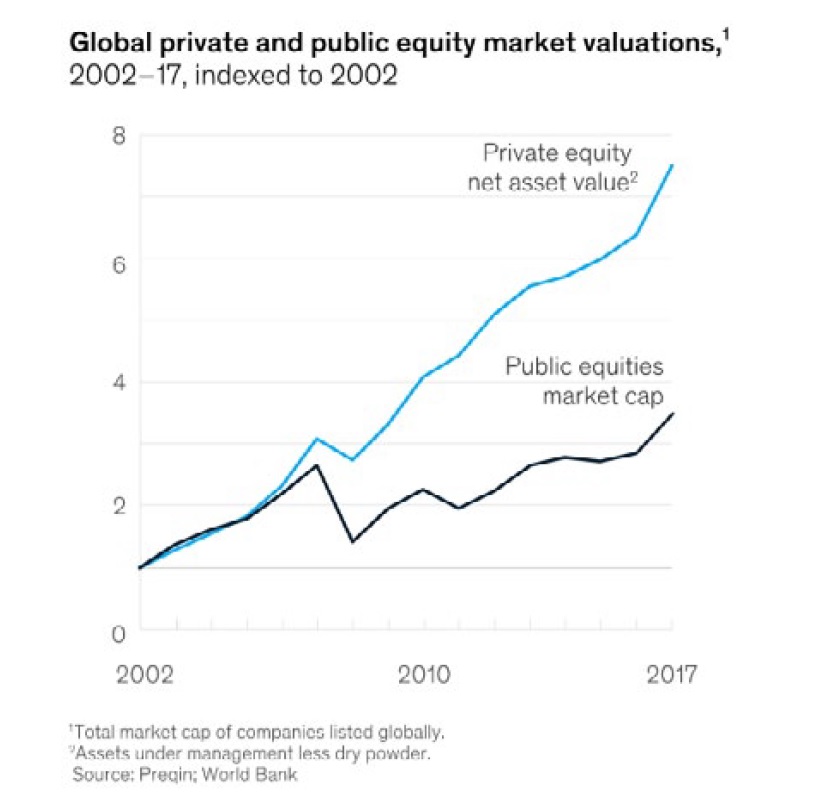

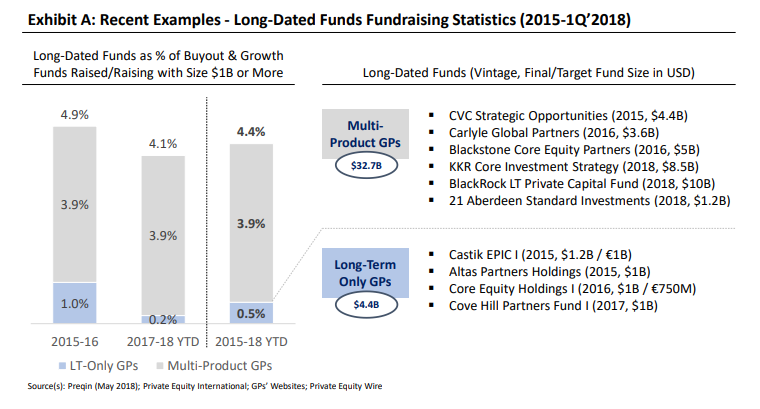

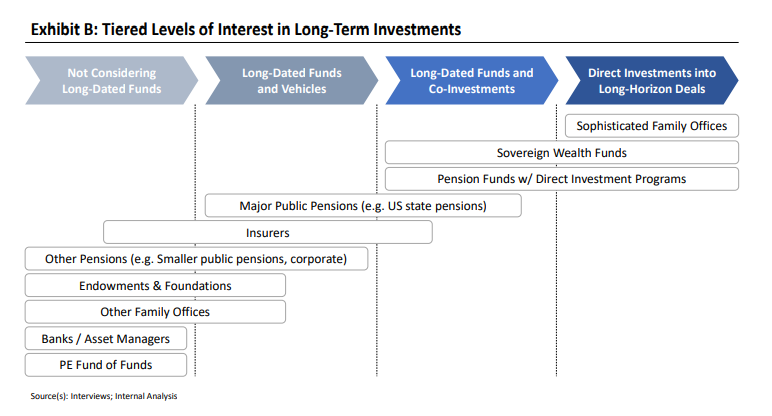

The Emergence Of Long Term Capital In Private Equity Mpe

Www Dtcp Capital Media Uploads Pe Intern Pdf

Open Ended And Evergreen Funds In Venture Capital Toptal

Eb 5 Regional Center Program Sunset 500 000 Investment Lcr Capital Partners

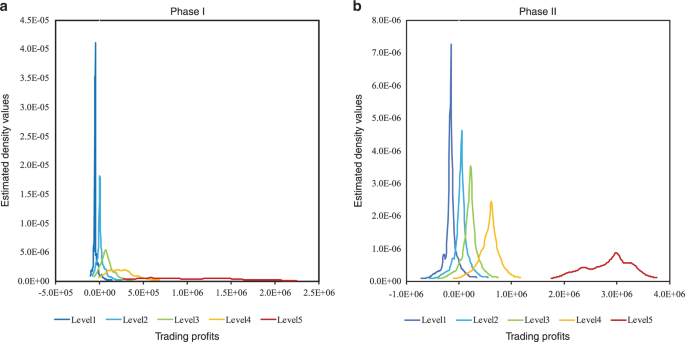

Assessing The Impact Of Ets Trading Profit On Emission Abatements Based On Firm Level Transactions Nature Communications

Level 5 Capital Partners Started Small Became Big And Partnered With Big Blue Swim School To Become Even Bigger As A Franchisor

Www Kslaw Com People Raymond Baltz Pdf Locale En

Venture Capital Careers Work Salary Bonuses And Exits

Sydney Entrepreneurs Today From 6 00pm 8 30pm Hatchlab Is Running A Panel Discussion On Careers At Start Ups In The Refectory Level 5 Abercrombie Building H70 See The Attached Flyers From More

2

Cvc

Sourcing Procurement Specialist Level 5 Capital Partners Career Page

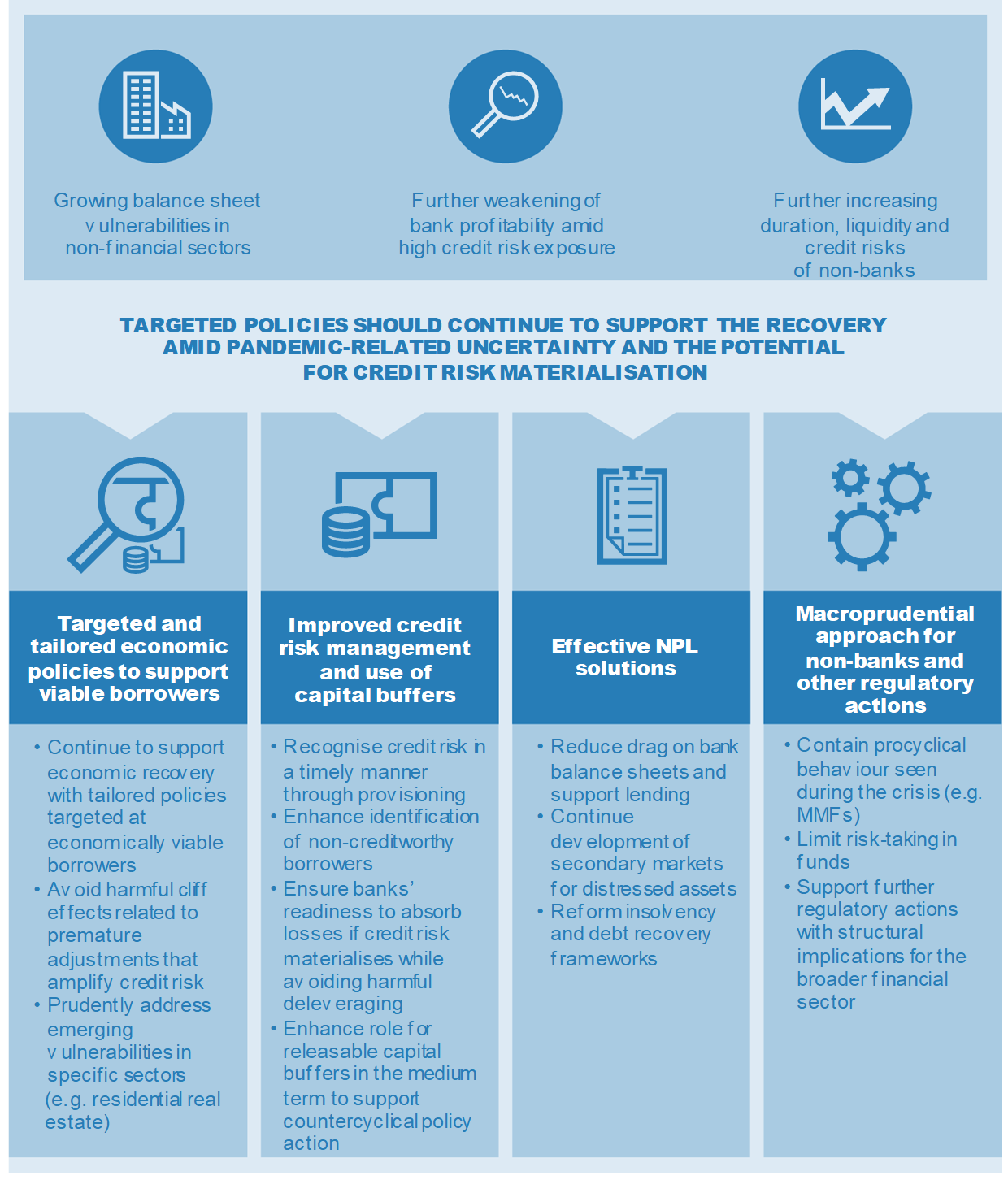

Financial Stability Review May 21

Level 5 Capital Partners Crunchbase Investor Profile Investments

2

Shareholders Are Getting Serious About Sustainability

Skin In The Game General Partner Capital Commitment Investment Behavior And Venture Capital Fund Performance Sciencedirect

The Emergence Of Long Term Capital In Private Equity Mpe

Audiobook The Business Of Venture Capital Insights From Leading Prac

Responsible Investor Response Global Media

Level 5 Capital Partners Crunchbase Investor Profile Investments

Leading Pe Vc Infrastructure Private Credit Placement Agent 5capital

Structural Business Statistics At Regional Level Statistics Explained

Level 5 Capital Partners Llc Company Profile And News Bloomberg Markets

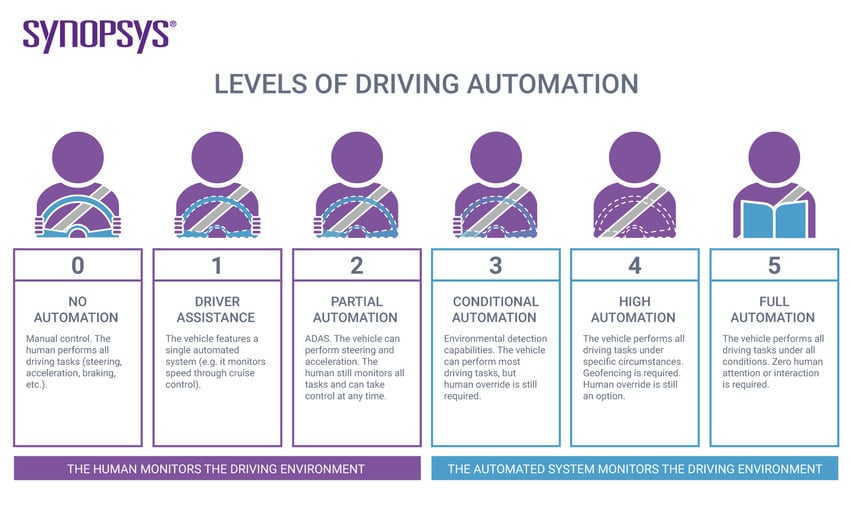

What Is An Autonomous Car How Self Driving Cars Work Synopsys

Corporate Paralegal Lawmatch

Joint Sdg Fund Jointsdgfund Twitter

Safyr Capital Partners

Heyday Closes Million Series B Round Led By Level 5 Capital Partners L5 Business Wire

How A Focus On Passion Brands Led Private Equity Group Level 5 Capital Partners To Invest By Big Blue Swim School Franchise Issuu

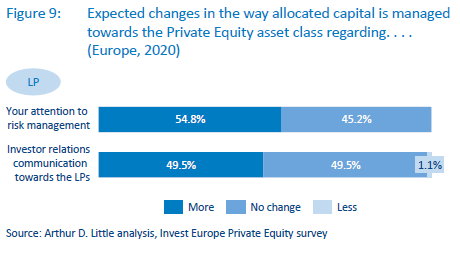

The Insight Europe S Private Equity Industry During Covid 19 And Beyond Arthur D Little

Venture Capital Wikipedia

Pandemic Economic Uncertainty Slow Us Private Equity Deal Activity In Q1 S P Global Market Intelligence

/dotdash_Final_Two_and_Twenty_Oct_2020-01-7ca86fbd38b64e59a879a71b9ad779eb.jpg)

Two And Twenty Definition

Level 5 Capital Partners Email Formats Employee Phones Investment Signalhire

Who Raised The Largest Fund In September Private Equity International

0 件のコメント:

コメントを投稿